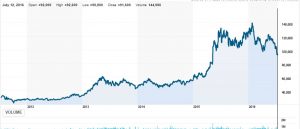

If the shareholders of PT Graha Layar Prima (BLTZ) at the Rights Offering do not exercise their rights, then CJ CGV, co.ltd., the ruler of the Korean cinemas, will be the second in control after PT Layar Persada. CGV’s share price was high in 2015, but down in the beginning of 2016. How is CGV’s performance in the eyes of international analysts?

CGV recorded revenues at KRW1.20 trillion or US$ 1 billion in 2015 and expects the record to rise at KRW1.35 trillion or US $ 1.18 billion. Net income amounted to US$ 57 billion and will amount to US$ 75 billion in 2016. Its assets worth US$ 1.21 billion in 2015 will be valued at US$ 1.42 billion, up 17%. Equity is at US$ 390 million and its market capitalization is at US$ 2.28 billion. This figure reflects a PBV of 5,9x. At the end of 2015, CGV operated 117 sites and 850 screens in five markets, excluding Korea.

CGV’s catalysts according to Kevin Jin of Daiwa Securities who recommends BUY, are the growth of China that will be spiking once fully operational; the cash-cow in the Korean market; and Vietnam which will add its contribution. On the other hand, the main risk faced by the company is eroding profitability due to very high capital expenditure in overseas markets. CGV has been proven to control costs in the Korean and China markets, but the same competence have not been proven in other markets such as Vietnam, Turkey and Indonesia.

source: Reuters

Add Comment