- The negative coal company’s average growth, except PTBA

- Buy: PTBA, upside potential is by 11%

Relying on Domestic Market, PTBA Grows by itself

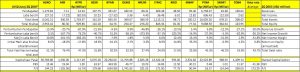

The coal company’s average growth on the first term is -20%. The decrease pressured net profit so it fell by 26,1%. The low coal price and lack of alternative which can be taken with low price is the cause of this decrease. Moreover, although the coal demand increased, it is not as big as the existing supply.

The coal company’s average growth on the first term is -20%. The decrease pressured net profit so it fell by 26,1%. The low coal price and lack of alternative which can be taken with low price is the cause of this decrease. Moreover, although the coal demand increased, it is not as big as the existing supply.

Different listed company with the others is Tambang Batubara Bukit Asam (Persero) tbk (PTBA). PTBA is recorded revenue growth by 3,8% although its net profit fell by 27%. The sales growth comes from higher capacity of electricity production in Indonesia. Same as the recommendation avoiding China, then PTBA will sell the coal back to China on the third or four quarter of this year. By the implemented mining holding, PTBA’s bottom line is expected to be better.

Buy: PTBA

The PTBA’s average target price is 11.300 IDR/ share. With the current price of 10.150 IDR, the upside potential reached 11%. The potential is higher than Adaro Energy Tbk (ADRO) with an average of 1.240 IDR or increase by 1% and Indo Tambangraya Megah Tbk (ITMG) with an average of 12.425 IDR or increase by 9%. The PTBA’s main catalyst is its participation on Indonesian electricity.

Add Comment