- High retail companies’ growth is supported by purchasing power growth

- BUY: AMRT

- Acquisition of Mataharimall.com, the LPPF’s upside potential is only 11%

High Retail Companies Growth

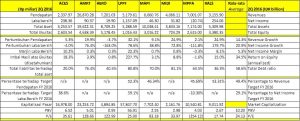

The average growth of retail companies is high. Revenue grew to 14,3% while the profit grew to 20,9%. The highest revenue growth recorded is by Midi Utama Indonesia tbk (MIDI) and Ramayana Lestari Sentosa tbk (RALS). The highest profit growth recorded is by RALS and Sumber Alfaria Trijaya tbk (AMRT).

The average growth of retail companies is high. Revenue grew to 14,3% while the profit grew to 20,9%. The highest revenue growth recorded is by Midi Utama Indonesia tbk (MIDI) and Ramayana Lestari Sentosa tbk (RALS). The highest profit growth recorded is by RALS and Sumber Alfaria Trijaya tbk (AMRT).

This good news is encouraged by the recovery of people’s purchasing power and shopping trend towards the modern retail. Some of the company strategies also support the improvement of profitability performance. RALS changed the old Robinson flagship with fresher SPAR brand. Many companies are also shifting to e-commerce. Ace Hardware Indonesia tbk (ACES) acquired ruparupa.com. Matahari Department Store tbk (LPPF) expanded mataharimall.com. And don’t forget AMRT with their Alfaonline and Alfacart.

BUY: AMRT

With the largest turnover, the AMRT’s upside potential is also the highest at 31,3%. Their catalyst is the expansion for traditional shops and their ability to maintain credit profile with low leverage. In 2016, AMRT is targeting to open 1.000 shops.

Mataharimall.com Only Creates Low Addition Values

LPPF added more stocks on mataharimall.com. E-commerce segment is expected to start bringing in profit by 2019. But, the analysts have not yet included this into the calculation of the company’s target value. The average analyst target price is only 22.090 IDR, or 11% above the current price which is 19.900 IDR.

Add Comment