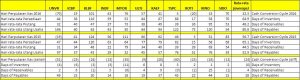

Cash Conversion Cycle (CCC) in consumer sector drops from 56.7 days to 32.3 days. CCC describes how many days the company should seek cash to cover their operation. What does the drop mean?

We calculate CCC by adding the days of receivables and days of inventory which is where the company has not yet received the cash. Then we minus it with the days of payables, which is where the company is still able to keep the cash.

The shorter the days of CCC, the better and more liquid its cash management; but otherwise, the company has to find other funding sources only for operational activity.

The drop is caused by the increasing days of payables. It shows that the sector has the higher bargaining power than the suppliers. The big companies like Unilever Indonesia tbk (UNVR), Tempo Scan Pacific tbk (TSPC), and Kino Indonesia tbk (KINO), are able to extend the debt payment more than 40 days. This is due to higher trust towards the debtors. Or maybe the suppliers are struggling to find a customer so they are willing to extend at least the sales are achieved.

Near 0 CCC is expected so the company do not need the credit facilities to cover CCC; otherwise a negative CCC will have the risk which is the company will be considered to be hardly work together. UNVR can do that due to its large market in Indonesia so creates a higher bargaining power.

Add Comment