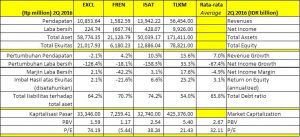

- Telco’s average rise in revenue is by 7%, while the increase is encouraged by the revenue from data.

- EXCL and ISAT rise from multi-year loss.

- The ISAT’s average target price is 4.550 IDR. The upside potential is by 47,7%.

The Telco’s average had strengthened

After recording the first profit for the past few years of losses, Indosat Ooredoo Tbk (ISAT) and XL Axiata Tbk (EXCL) has finally recorded profits. ISAT’s profit is 428,1 billion IDR; EXCL’s profit is 224,7 billion IDR. Telkom Tbk (TLKM) is still maintaining its net profit growth of 33,3%.

The bottom-line improvement is supported by the strengthening of the revenue from data. ISAT’s revenue data increased by 55,5%; EXCL increased by 22,4%; TLKM increased by 33,9%. Telephone and SMS still have a significant contribution in all three revenues.

From the four listed companies that released their reports, only SmartFren Telecom Tbk (FREN) recorded losses. The rising total revenue is encouraged by the data segment. But the rent cost, frequency, and finance is still incriminating FREN’s margin.

BUY: ISAT

After its transformation, ISAT has some good strategies to overcome losses. The first one is to conduct a massive rebranding. Two, reduce the foreign debts by obligation and internal cash. Three, increase the mobile digital business for enterprise segment. Four, related to the price war to seize the marketing share. Last, a massive investment for the expansion of 4G LTE internet services.

As the result, many analysts recommended BUY. The average target price reached 4.550 IDR, or 47,7% above the current price, which is 3.080 IDR.

Add Comment