- The listed gadgets retail revenues are growing: ERAA, MKNT, TELE

- Compete for opening shops, the marketing costs are high

- The TELE’s average target price is 1.050 IDR; the upside potential is by 65%

- The ERAA’s average target price is 750 IDR; the downside potential is by -14%

The High Retail Gadget Sale, BUY: TELE

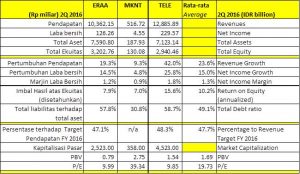

Indonesia still proves to be the largest smartphone market in Southeast Asia. The proof is that this year, the retail gadgets experienced rapid growth by 23,6%. As a result, the average net profit also increased by 15%. The highest increase was experienced by Tiphone Mobile Indonesia Tbk (TELE), the main distributor of Telkomsel vouchers.

Vouchers business contributed up to 60% of TELE’s total revenue. This contribution is estimated to rise to 80%. The composition made TELE’s profit margin the highest compared to others. TELE’s net profit margin is higher at 1,8% compared to an average of 1,3%. This segment is TELE’s backbone and cashcow. In the future, TELE will still invest to strengthen this segment. Moreover, people’s purchasing power has begun to recover.

Vouchers business contributed up to 60% of TELE’s total revenue. This contribution is estimated to rise to 80%. The composition made TELE’s profit margin the highest compared to others. TELE’s net profit margin is higher at 1,8% compared to an average of 1,3%. This segment is TELE’s backbone and cashcow. In the future, TELE will still invest to strengthen this segment. Moreover, people’s purchasing power has begun to recover.

Because of their high performance and solid business, TELE is more likeable. The TELE’s average recommendation price reached 1.050 IDR. Besides, TELE’s market price is still 635 IDR. This means that there is an upside potential until 65%. One of the catalysts is the high demand of data mobility in Indonesia. TELE that is almost finished will produce LG Smartphone that has started to be approved by users.

Surviving in the Competition: High Selling Expense

Although the gadget market growth is high in Indonesia, it does not mean that the company can relax. The low costs of moving products, the substitute availability, and low brand loyalty is the characteristic of this industry. To maintain the marketing share, the three companies raise their sales and promotions.

The average increasing marketing cost and sales of the three companies is by 255%. Mitra Komunikasi Nusantara Tbk (MKNT) is recorded the highest by 6 times. It is the sole agent branded Cyrus and is the last one who conducted an IPO.

Meanwhile, Erajaya Swasembada Tbk (ERAA) keeps increasing its market control by opening shops. ERAA responded to the customer needs to experience before buying. By the second quarter, ERAA’s shops have increased by 6. This year’s target is achieving 40-50 new shops and refurbishing 40 old shops. ERAA is working together with Indosat Ooredoo Tbk (ISAT) to open 300 shops until 2017.

Retail gadgets Trikomsel Oke Tbk (TRIO) is still waiting for PKPU progress from the bond holder. Meanwhile, Global Teleshop Tbk (GLOB) is still being suspended.

.

Add Comment